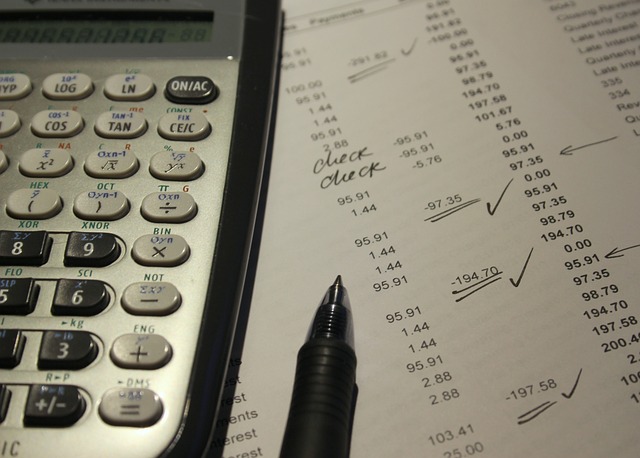

The accounting industry has come a long way in terms of development over the years. What was previously known as solutions based on manual, paper-based record keeping and bookkeeping are steadily being replaced by digital tools. Today's accountants are now taking advantage of modern technologies in the form of mobile and web applications to improve efficiency, streamline the accounting processes they carry out and, most importantly, have constant access to real-time data.

In the following article, I will present the benefits of using web and mobile applications in accounting. I will discuss the different types of solutions available on the market, as well as present applications from Railwaymen that work well in the day-to-day business operations of accounting clients.

Table of Contents:

1. Advantages of web and mobile applications in accounting.

2. Types of web and mobile applications for accounting.

3. Implementation and adoption of web and mobile applications in accounting.

4. Examples of top web and mobile apps for accounting.

5. The future of web and mobile applications in accounting.

6. FinTech solutions developed by Railwaymen.

Advantages of web and mobile applications in accounting

There are many benefits of implementing a custom application for an accounting business. Here are some of the most commonly cited reasons why you should invest in implementing such a solution for your business.

Increased efficiency and productivity

With the help of web and mobile applications, accounting professionals can carry out their duties much more efficiently. These tools allow them to get rid of the need to manually enter data and post complicated spreadsheets. The use of apps contributes to reducing the time and resources required for accounting tasks. As a result, professionals can focus on any duties that have a higher priority.

Real-time data access and analysis

Modern web and mobile applications contribute in accounting to constant access to financial data regardless of the time of day or geographical location. All you need is an Internet connection to access all the functionality of the system. Having real-time access contributes to having a more accurate and real-time picture of a company's financial condition. This allows businesses to make decisions faster and manage their finances better.

Improved accuracy and reduced errors

Accounting has gained the ability to automate thanks to technological advances. The digitization of legacy processes means that many tasks that require focus and accuracy do not have to be performed solely by humans. This reduces the risk of errors and translates into accuracy. At the same time, entrusting certain tasks to an electronic system ensures compliance with current accounting regulations.

Enhanced collaboration and communication

Accounting apps influence collaboration and communication among accounting professionals. Information flow is also streamlined for other departments and stakeholders outside the company. Working with apps can translate into better team relations, reduce silos, and ensure everyone is on the same page.

Cost savings and improved profitability

FinTech solutions are not only impacting work, but more importantly, saving the company money. The use of modern applications makes it possible to minimize paperwork and reduce existing expenses. These measures are reflected in the efficiency and effectiveness of the accounting team.

Types of web and mobile applications for accounting

Accounting consists of many areas that are responsible for specific processes. Each of them requires reliability and accuracy on the part of employees. Sometimes even the smallest mistake can contribute to serious complications. Therefore, in order to facilitate the daily work of financiers, web and mobile applications are created to support the various processes. Here are some types of apps that are dedicated to the accounting sector.

Software with web and mobile access

These solutions are designed to provide a company with a comprehensive set of accounting tools. Among them are applications that support invoicing, or those dedicated to payroll, financial reporting and tax preparation. With access to the web and mobile devices, today's accountants perform their assigned tasks regardless of location or time.

Time and expense tracking applications

Thanks to various types of trackers, employees working in the FinTech industry can keep track of their time and all kinds of expenses. This is an important convenience that affects efficiency in billing customers and managing budgets. Tracking makes it possible to observe the necessary data both while in the office and when undertaking remote work.

Invoice and payment processing applications

Applications automate the full process of invoicing and all payments while contributing to simpler billing of customers and receipt of payments. Accounting solutions nowadays are so developed that they can be used at any time and according to your needs.

Financial analysis and reporting applications

What would accounting be without the numerous reports it uses in its daily tasks? Reports, compilations, analysis, all of these are the daily routine of financial employees. That's why a lot of work has gone into developing applications to monitor finances and identify prevailing trends. Thanks to the Internet, the possibilities of such solutions stand at a very high level, which contributes to the realization of high-quality tasks.

Budgeting and forecasting applications

Work in accounting is sometimes based on forecasting the future. And while I don't mean fortune-telling, there are solutions that allow predicting events related to budgets. FinTech applications have functions for forecasting based on available data and determining possible trends in finances.

Implementation and adoption of web and mobile applications in accounting

The implementation and adoption of web and mobile applications in accounting certainly passes as a challenge. However, the right approach and consistency are the keys to success in this case. Supporting accounting processes through new technologies not only allows for greater accuracy of operations, but also allows accountants to focus on areas previously unexplored in their daily work. Automation also contributes to increased competitiveness among like-minded companies.

Here are some steps that bring you closer to successfully implementing an accounting application into your enterprise:

- specifying clear objectives;

- selecting the right applications;

- providing appropriate training and support;

- adopting an application adoption strategy.

Examples of top web and mobile apps for accounting

QuickBooks Online is a cloud-based accounting software that provides web and mobile access to a comprehensive suite of accounting tools. The application is easy to use and provides real-time data access and analysis, making it an ideal choice for small businesses and self-employed professionals.

Expensify is a mobile application that simplifies expense tracking and reporting. With features like automatic receipt scanning and integration with popular accounting software like QuickBooks and Xero, Expensify makes it easy for accounting professionals to manage expenses on the go.

Xero is a cloud-based accounting software that provides web and mobile access to a range of accounting tools, including invoicing, payroll, and financial reporting. Xero is known for its ease of use and integration with other business applications, making it a popular choice for small and medium-sized businesses.

The future of web and mobile applications in accounting

The development of web and mobile applications in accounting is promising. We may expect seeing even more potent and cutting-edge programs that aid in streamlining accounting procedures, increasing productivity, and supplying real-time data access and analysis as technology continues to advance. Some of the trends we can predict seeing are as follows:

Artificial intelligence and machine learning: Accounting software already employs AI and ML to automate processes and give more precise data analysis. We may expect to observe even more effective applications that support the optimization of accounting operations as these technologies continue to advance.

Blockchain technology: By offering a transparent and secure method to store and manage financial data, blockchain technology has the potential to transform accounting. Future accounting apps based on blockchain are something we can expect to become more common.

Data security: As web and mobile applications are used more and more in accounting, data security will become even more crucial. To protect sensitive financial data, we can anticipate an increased focus on data security techniques like encryption and multi-factor authentication.

FinTech solutions developed by Railwaymen

- Hydr (United Kingdom) - platform that allows full accounting of invoices in as little as one day when the right conditions are met.

.jpg?width=1200&height=630&name=hydr-0dc377fee7327734279ad3d4b75%20(2).jpg)

- CostTracker (Norway) - cloud-based solution that enables enterprise cost control through personalized software.

.png?width=1200&height=630&name=costtracker-b0b4a9151582a107a2f8%20(2).png)

- FreshPay (United Kingdom) - comprehensive software for automating payroll issuance for accountants, employers and employees in the UK

-1.jpg?width=1200&height=689&name=freshpay-a4ecc04075591fb24a49bce%20(2)-1.jpg)

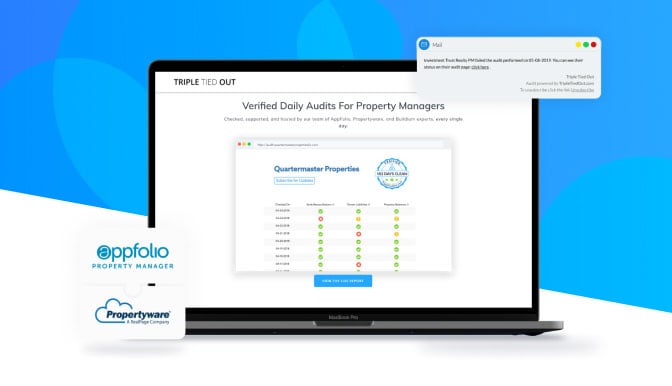

- Triple Tied Out (United States) - FinTech software to generate daily financial reports for real estate institutions.

- MortgageHippo (now Revvin) (United States) - customer service engine that enables financial institutions to provide the best credit solutions.

- CreateCoin (United States) - platform to earn cryptocurrency rewards for all kinds of business ideas and opinions

If you would like to learn more about the creation of the above projects, then we encourage you to visit the Case Studies section of our website. Find out what's behind the success of each of our applications, and consider whether your company needs an additional boost to its development in the form of a useful tool.

Do you want to know how Open Banking and API Integration are changing the banking industry?

Our latest e-book "The Future of Banking: The Impact of Open Banking and API Integration" provides a comprehensive overview of these changes. With real-life examples and expert analysis, you will be able to adapt to the new landscape and succeed in the FinTech sector.

DOWNLOAD NOW

%20(1).jpg)