FinTech stands for financial technology, which is reshaping how conventional financial institutions conduct business and helping to provide better banking and financial services.

The global FinTech market is facing growing demand for financial and digital banking services as traditional banks and insurance companies increasingly replace outdated operating systems with cutting-edge technology. Currently, newly established technological companies offer a user-friendly environment for carrying out process payments and thanks to which, they can maintain their market dominance and offer the best financial technology.

Table of content

1. From FinTech Startups to Financial Giants: A Deep Dive into the Global FinTech Market.

2. The list of Top FinTech Companies worth watching in 2024.

3. FinTech solutions developed by the Railwaymen.

From FinTech Startups to Financial Giants: A Deep Dive into the Global FinTech Market

As we move into 2024, the total number of companies that use financial technology is over 30,000 and still growing. The FinTech industry is currently one of those that is expanding the fastest in the globe and according to the Global FinTech Market Report by 2025, it is predicted to reach a size of around $305 billion with an average annual growth rate of about 20%.

Thanks to the technological trends in finance industry such as Big Data, Artificial Intelligence (AI), Internet Of Things (IoT), machine learning and Cloud Computing companies like startups, small businesses and medium-sized businesses can contribute to the constant development.

So, if you are wondering which top FinTech companies are worth keeping an eye on this year, you've come to the right place! We have prepared a list of FinTech companies that offer various financial tools and services.

You can find the list below!

The list of Top FinTech Companies worth watching in 2024:

#Klarna

Klarna is a Swedish FinTech platform that offers financial services such as direct payments, payments for online stores, and post-purchase payments. Thanks to Klarna, the customer can buy now and pay later with the use of installment payments spread over time.

#Stripe

Stripe is an Irish-American financial services and software as a service business that enables companies to make payments online. This FinTech startup is popular and is usually the first choice of e-commerce businesses as it offers some of the lowest rates available in the market.

#Cash app

Cash App is an example of peer-to-peer (P2P) payment app that was created in US. It allows individuals to easily send and receive money from others. Except of mobile banking, Cash App also offers the option to purchase stock and Bitcoin through its platform.

#Lemonade

Lemonade offers financial services and provides life, auto, pet, renters, and homeowner's insurance. The insurance process is powered by artificial intelligence. This FinTech startup aspires for zero paperwork by replacing brokers and bureaucracy with bots and machine learning. The company takes the flat price, settles the claims, and then, if there is any money left over, donates it to community-selected social causes.

#Robinhood

Robinhood is a US-based financial services company that enables to invest in stocks and other stocks worldwide commission-free and open a low-cost brokerage account accessible via a mobile application. This FinTech startup is valued at around $5 billion, making it one of the unicorns.

#SoFi

SoFi is an American financial technology company with the aim to give students opportunity to get an accessible loan and debt repayment options. To the main areas of expertise for SoFi belong personal loans, student loan refinancing, and mortgages.

FinTech solutions developed by the Railwaymen

Railwaymen also has an impact on the FinTech industry, especially in the United Kingdom. The financial tools created by the software, which could prove crucial for many companies, are definitely worth a look in 2024202.

Meet Hydr, Triple Tied Out, FreshPay and CostTracker.

#Hydr

Hydr is an online platform that provides full invoice financing in just one day and enables companies fast and stress-free payment under transparent conditions. It is possible due to the software that verifies the customer, aggregates data in one place and improves decision-making. In addition, the risks associated with funding individual invoices are significantly reduced - all in one platform.

.jpg?width=1200&height=630&name=hydr-0dc377fee7327734279ad3d4b75%20(2).jpg)

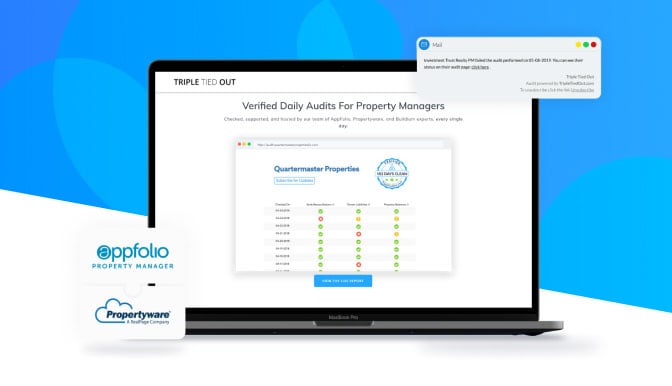

#Triple Tied Out

Triple Tied Out is a FinTech tool that enables users of a property management system to create financial audits regularly. All based on the essential accounting standards. It ensures that bank reconciliations are up-to-date and done correctly, that the tenant's balance on the bank account can cover all liabilities. The additional feature also helps the owner's property balances keep well maintained.

#FreshPay

FreshPay is a cloud-based system that allows to settle payslips more efficiently. It helps companies reduce the time required to run payroll through automating processes, eliminating manual steps, and increasing collaboration. FreshPay offers its clients a solution that streamlines standard payroll activities while providing the necessary support.

-1.jpg?width=1200&height=689&name=freshpay-a4ecc04075591fb24a49bce%20(2)-1.jpg)

#CostTracker

CostTracker is a financial technology platform which helps small businesses as well as medium-sized businesses save time and money through real-time cost control. It also enables companies to plan a purchase and budget in real time, cash flow forecast and generate direct report.

Conclusion

Nowadays, FinTech companies which its cutting-edge technology makes use of new business models to provide consumers and businesses with various digital assets and financial services. That is why, in the coming years, we can expect a significant increase in innovation as the sector develops.

We excel in delivering high-performance FinTech platforms and systems on time. If you have anything to discuss, check out our portfolio and contact us!

Discover the future of banking and take part in the upcoming changes

Are you concerned about the future of banking and how it will affect the entire industry? Look no further than our e-book "The Impact of Open Banking and API Integration on the Future of Banking". This comprehensive guide will provide you with all of the information you need to stay ahead of the curve in this rapidly changing landscape. Find out what kind of future is being written for the FinTech industry and how to best prepare your company for it.

DOWNLOAD NOW