Nowadays, we are witnessing a dynamically changing FinTech industry. This is evidenced by the frequent appearance and use of new, emerging technologies in the financial sector. According to the Global FinTech Market Report, by 2025, it is estimated to reach a size of around $305 billion with an average annual growth rate of about 20%.

Without hesitation, you can see that many products and solutions offered by a various FinTech firms have been implemented in our daily lives, for example the ability to log in to bank accounts, pay for goods or services, take out loans and keep all the financial data in one place.

When it comes to financial institutions like traditional banks, they are constantly adapting to meet the needs of their customers, serve existing customers, and prevent fraud.

In this article, we look at the top FinTech trends that will shape the future as our world increasingly turns to digital solutions. Check out our list of key FinTech trends to see what's next for this emerging industry.

Table of Contents:

- 1. List of 5 FinTech Trends with the impact on the Financial Industry.

- 1.1. Digital Payments.

- 1.2. Artificial Intelligence and Machine Learning.

- 1.3. Blockchain Technology.

- 1.4. RegTech (Regulatory Technology).

- 1.5. Embedded Finance.

- 2. FinTech solutions developed by Railwaymen

- 2.1. CreateCoin.

- 2.2. CostTracker.

- 2.3. Hydr.

- 2.4. Triple Tied Out.

- 2.5. FreshPay.

- 3. The Future of Finance.

- 4. Conclusion.

List of 5 FinTech Trends with the impact on the Financial Industry

#Digital Payments

The emergence of digital payments methods is one of the most important trends shaping the future of financial technology - they are the basis for making payments via mobile devices such as smartphones, tablets or PCs. Also, with the help of created systems such as Apple Pay, Samsung Pay or Google Wallet, customers do not need cash or credit cards to complete financial transactions because they are able to use digital wallets via their mobile devices.

Aside from their convenience at the checkout, digital wallets have the potential to solve a previously disjointed and difficult-to-navigate cross-border banking problem.

#Artificial Intelligence and Machine Learning

The global value of the Artificial Intelligence FinTech market is estimated to reach USD 26.67 billion by 2026, maintaining a compound annual growth rate of 23.17% in 2021-2026.

Artifice Intelligence is a definition refers to machines that are able to perceive their surroundings and take actions that increase their chances of success. Machine Learning can be described as an application of A. It employs algorithms to learn from data and identify patterns in it.

FinTech companies can use both technologies to automate processes such as fraud detection and loan landings. Due to the adopting by financial institutions AI technology and Machine Learning for analytics, there is the potential to reduce global operating cost and increase overall accuracy and efficiency.

Currently, traditional banks and other financial institutions are advised to adopt an AI-based approach that will better prepare them to remain competitive and market position.

#Blockchain Technology

Blockchain Technology was originally created for the rapid transfer of digital assets such as stocks and bonds, and is now being used to increase the efficiency of many financial processes.

This technology underpins cryptocurrencies such as Bitcoin, but it also allows for the development of a wide range of additional applications.

One of the most significant advantages of blockchain technology is its high level of security and resistance to fraud. As a result, it is especially beneficial to the financial services sector, as it can be used to create secure and transparent financial transactions.

Blockchain is a constantly evolving technology that has aspirations for further growth and potential development. According to the PwC analysis, it is estimated that in 2025 blockchain will be adopted on a large scale in global economies.

#RegTech (Regulatory Technology)

Laws and regulations apply to all financial institutions. As a result, all businesses or organizations are required to keep accounting records, tax reports, income reports, and customer reports. All mentioned institutions are obligated to submit all documents to the regulatory institutions. They verify the correctness of data and the legality of the business. Regulatory technology is key in automating these processes. They, in turn, verify the correctness of the data and the legality of the business.

RegTech industry is the key to automating these processes.

Regulatory Technology is used to monitor the compliance of all business documents with the provisions of statutory law. Regulatory technology is designed to detect any issues in the documentation that do not comply with the rules and make them work with the applicable system.

Specialized software automates repetitive procedures, ensures data security and warns users and bank employees against potential abuses. It also allows organizations to communicate with their regulators to ensure seamless data flow, compliance monitoring and financial crime tracking.

#Embedded Finance

In the FinTech industry, embedded finance is gaining ground and is likely to gain more popularity this year.

The term "embedded finance" is commonly used to describe a broad category of financial services and products that can be used within a specific framework or on a specific platform.

It enables each user to better and more efficiently manage their finances in one existing application or platform. Companies can use embedded payments to provide comprehensive offerings throughout a customer's journey, increasing customer satisfaction and business revenue. Banking, credit, investment, payment processing, lending, and insurance are all examples of financial services.

When it comes to forms of embedded financing, special attention should be paid to the developing BNPL sector, which means buy now pay later. This payment option allows buyers to buy now and basically pay later, usually by dividing the purchase amount into several smaller installments so that buyers feel comfortable paying the bill. Buy now pay later is more popular among the young customers because they prefer this option over credit cards.

Currently, new emerging FinTech companies have great potential to revolutionize traditional ways of doing transactions, thanks to the flexibility of the embedded finance market.

FinTech solutions developed by Railwaymen

As a Software House, Railwaymen has an impact on the FinTech industry, especially based in the United Kingdom.

Meet CreateCoin, CostTracker, Hydr, Triple Tied Out and FreshPay.

#CreateCoin

CreateCoin is the world's first Blockchain ideas platform. The platform is based on a gamification model, which is based on providing feedback from users. Prizes in the form of cryptocurrencies are provided for the most engaged users. It’s an open platform for everyone who wants to be involved in the innovative projects’ development.

.png?width=1200&height=847&name=final-25f598fd9f25d85f52587b13cc%20(1).png)

#CostTracker

CostTracker is a financial technology platform which helps small businesses as well as medium-sized businesses save time and money through real-time cost control. It also enables companies to plan a purchase and budget in real time, cash flow forecast and generate direct report.

![]()

#Hydr

Hydr is an online platform that provides full invoice financing in just one day and allows businesses to pay quickly and stress-free under transparent conditions. This is made possible by software that verifies the customer, aggregates data in one location, and improves decision-making. Furthermore, the risks associated with funding individual invoices are greatly reduced - all on a single platform.

.jpg?width=1200&height=630&name=hydr-0dc377fee7327734279ad3d4b75%20(2).jpg)

#Triple Tied Out

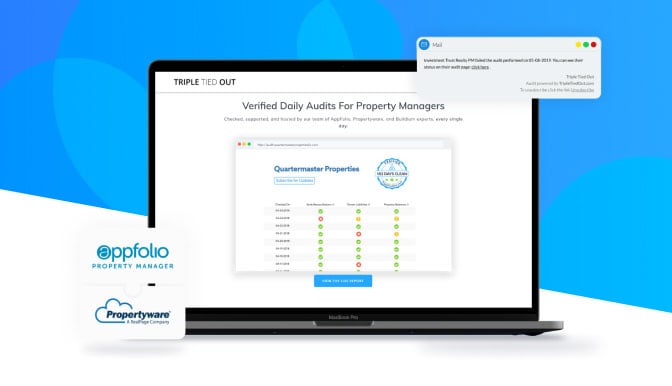

Triple Tied Out is a FinTech platform that provides financial audits to property management system users. All financial accounts can be audited using the tool. Users can use this app to keep track of their financial records daily. It includes per-property balances and tenant liability compliance. TTO's goal is to automate the process of obtaining company documentation without requiring a physical visit to the company's premises.

#FreshPay

FreshPay is a cloud-based system that allows to settle payslips more efficiently. It helps companies reduce the time required to run payroll through automating processes, eliminating manual steps, and increasing collaboration. It also offers its clients a solution that streamlines standard payroll activities while providing the necessary support.

-1.jpg?width=1200&height=689&name=freshpay-a4ecc04075591fb24a49bce%20(2)-1.jpg)

The Future of Finance

In the coming years, financial technology will continue to be seen as the driving force of the future because now, we are in the middle of digital transformation.

We are already seeing an increase in the use of blockchain, Artificial intelligence and machine learning technologies in financial transactions. The automation of financial processes as well as their subsequent integration will become more and more sophisticated.

When it comes to traditional banks, they will have to try to implement new solutions on an ongoing basis, trying to offer customers interesting solutions and banking services in order to maintain a competitive position in the market compared to financial technology.

Conclusion

The industry is booming and its development generates an increased demand for experts (like us) who will keep a close eye on and keep you updated on all new FinTech trends and how they are transforming the future of finance and the market.

We expect FinTech to become increasingly important as the boundaries between the digital and physical worlds blur.

If you are interested in FinTech, we encourage you to read our recent blog articles:

How FinTech is Revolutionizing Banking? Digitalization in Finance

FinTech vs Traditional Banking: What's the Difference?

10 Benefits of FinTech for small business owners

If you have an idea that you would like to discuss with us, try the Discovery Phase service we offer, thanks to which we will lay the foundations backed by the initial research and development process of your project.